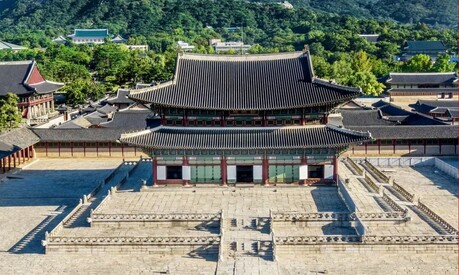

Courtesy of Mirae Asset Financial Group

Mirae Asset Global Investments is poised to finalize a merger with its subsidiary, Multi Asset Global Investments, by March next year. According to statements made to The Korea Times on Monday, the merger is scheduled for March 27, pending confirmation at a board meeting slated for January 3.

|

| ▲ Courtesy of Mirae Asset Financial Group |

Mirae Asset Global Investments, holding a 100 percent stake in Multi Asset Global Investments, will acquire the entirety of the subsidiary's business through the merger. The transaction falls under the category of a small-scale merger as defined by Article 527 of the country's Commercial Act. No new shares will be issued as part of the merger, ensuring that there will be no change in stock ownership or the ratio of the largest shareholder of Mirae Asset Global Investments after the completion of the merger.

The move is part of Mirae Asset Global Investments' strategy to enhance its global investment competence by consolidating key experts, diversifying investment portfolios, and improving management efficiency. The merger aims to respond effectively to changed external market conditions, consolidate alternative investment management capabilities, and explore new growth avenues through the diversification and specialization of alternative investment business. The plans also include expanding global alternative investment business and integrated risk management, according to a statement via the official electronic disclosure system DART.

Sayart

Joy, nunimbos@gmail.com

Merger Plan Confirmed for March 27 Following Board Meeting on January 3

Courtesy of Mirae Asset Financial Group

Mirae Asset Global Investments is poised to finalize a merger with its subsidiary, Multi Asset Global Investments, by March next year. According to statements made to The Korea Times on Monday, the merger is scheduled for March 27, pending confirmation at a board meeting slated for January 3.

|

| ▲ Courtesy of Mirae Asset Financial Group |

Mirae Asset Global Investments, holding a 100 percent stake in Multi Asset Global Investments, will acquire the entirety of the subsidiary's business through the merger. The transaction falls under the category of a small-scale merger as defined by Article 527 of the country's Commercial Act. No new shares will be issued as part of the merger, ensuring that there will be no change in stock ownership or the ratio of the largest shareholder of Mirae Asset Global Investments after the completion of the merger.

The move is part of Mirae Asset Global Investments' strategy to enhance its global investment competence by consolidating key experts, diversifying investment portfolios, and improving management efficiency. The merger aims to respond effectively to changed external market conditions, consolidate alternative investment management capabilities, and explore new growth avenues through the diversification and specialization of alternative investment business. The plans also include expanding global alternative investment business and integrated risk management, according to a statement via the official electronic disclosure system DART.

Sayart

Joy, nunimbos@gmail.com

Related articles

- Rare Goryeo Dynasty Najeon Chilgi Box on Display at National Palace Museum of Korea

- Cultural Heritage Administration Initiates Economic Growth and Digitization Measures Ahead of New Heritage Management Law

- Solbi's Resilience Against Cyberbullying Explored in Voice of America Documentary

- Korean Dramas Secure Four Nominations at 29th Annual Critics Choice Awards