France's art community is mounting fierce opposition to a controversial tax proposal that would impose new levies on art ownership as part of the country's 2026 budget. Two French parliamentarians have introduced legislation that would make France the only major art market center to implement a wealth tax specifically on the possession of artworks, sparking widespread condemnation from industry leaders.

A coalition of 27 prominent art world organizations has issued a lengthy joint statement condemning the proposal. The signatories include major players such as Art Basel, which recently held its fourth edition in Paris; the renowned auction house Drouot; the visual artist rights management organization ADAGP; the Association for the International Diffusion of French Art (ADIAF), which annually awards the Marcel Duchamp Prize; and the Professional Committee of Art Galleries (CPGA).

The proposed regulations are being championed by Jean-Paul Matteï of the Democratic Movement party and Philippe Juvin of the Republicans. According to their supporters, the new tax regime is designed to direct savings toward productive investment and combat tax avoidance. However, the art industry argues that this legislation unfairly targets a sector that is neither rent-seeking nor abusive in nature.

France represents a significant portion of the global art market, ranking as the world's fourth-largest art market and accounting for more than half of the European Union's market value at 4.2 billion euros, according to the latest Art Basel and UBS Global Art Market Report. Industry experts warn that a contraction in the French art market could result in devastating tax losses of up to 578 million euros (approximately $671.5 million) when considering the auxiliary industries that depend on the art market ecosystem.

Cécile Verdier, president of Christie's France, highlighted the practical challenges of implementing such a tax system. "Technically, how are you going to tax the fact that someone owns art?" she questioned during a phone interview. "You can tax art when it is bought or sold, but technically, if the people who own art haven't bought it recently – if they don't sell it, how are you going to tax them? Are you going to ring them at home and see if they have art? People will have to declare art."

Verdier expressed concerns about the broader implications of the proposed legislation. She predicted that collectors would stop buying and selling artwork to avoid taxation, instead choosing to pass pieces within their families. Additionally, she warned that museums would suffer as collectors become reluctant to lend artwork for exhibitions, fearing that public display would draw attention to their collections and increase their tax liability.

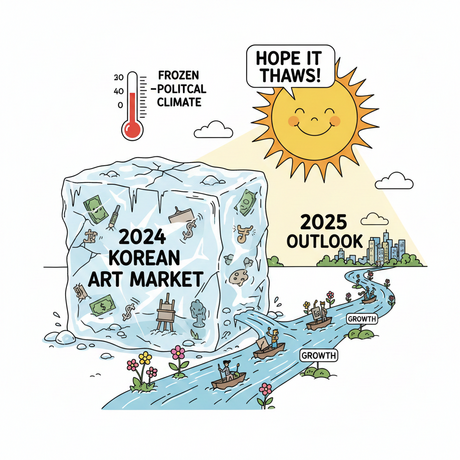

Paris-based art advisor Hailey Widrig pointed out that the proposal comes during a particularly turbulent period in French politics. "The government changes every week here," she explained. "It's been very chaotic since the spring." Widrig emphasized that the main problem with the new tax law is its inconsistency with similar legislation in other European Union nations, which would put French buyers and sellers at a significant disadvantage compared to their EU competitors.

Widrig also raised concerns about the practical implementation of artwork valuation for tax purposes. The proposed guidelines require that the value of artworks be assessed, but France lacks an organization comparable to the United States' Internal Revenue Service, making it unclear who would be responsible for determining the taxable value of artworks.

Kamel Mennour, a prominent Paris dealer, described the proposed tax regime as "a cold shower" following the successful Art Basel Paris event. "They want to kill art with this taxation," he stated emphatically. "It will make all the collectors leave." His sentiment reflects the widespread fear among art professionals that the new tax could drive wealthy collectors and their valuable collections out of France.

Art Basel has officially joined the opposition movement, with a spokesperson explaining that the organization signed the joint declaration "to echo the concerns of its galleries and the wider French art ecosystem about the potential inclusion of artworks as taxable goods in two amendments made to the 2026 French Budget Law, which is currently being debated in parliament." The spokesperson added that as an active participant in France's cultural landscape, Art Basel remains committed to supporting galleries and ensuring their continued success.

This isn't the first time French politicians have proposed similar measures targeting art collections. Christie's Verdier noted that a comparable proposal was considered in 1981 under French President François Mitterrand. "It's an old story and comes back on a regular basis," she observed. However, she pointed out an important distinction: "This was someone who really understood what culture means and had convictions about how to try to make rich people pay, but they never touched the art."

The timing of this proposal is particularly significant as it comes just after the successful conclusion of Art Basel Paris, which demonstrated the vitality and international appeal of France's art market. The contrast between the celebration of French cultural achievement and the threat of punitive taxation has intensified the art world's opposition to the proposed legislation. As parliamentary debates continue, the French art community remains united in its determination to prevent what they see as a potentially devastating blow to the country's cultural and economic landscape.