Thirty-two paintings by renowned artist Marc Chagall remain locked away in Swiss bank vaults, trapped at the center of a complex legal and financial battle. These artworks, valued at approximately $30 million, served as collateral for loans between French businessman Michel Ohayon and Barclays Bank, but their exact identity and location remain shrouded in mystery.

Marc Chagall (1887-1985) was a prolific genius whose naive yet poetic style, influenced by Jewish tradition and Slavic folklore, captivated the art world. His friend Pablo Picasso once said of him: "When he paints, you don't know if he's sleeping or awake. He surely has an angel somewhere in his head." Chagall's works have driven art markets wild, made buyers dizzy with excitement, and sold for eight-figure sums. However, in recent years, his paintings have created tensions not just in auction houses but in courtrooms as well.

The saga began in 2010 with a practice still uncommon at the time: art lending. According to Swiss publication Gotham City, French entrepreneur Michel Ohayon, head of FIB (Financière immobilière bordelaise), secured two credit lines totaling $50 million from Barclays Bank in Switzerland and Monaco. As collateral for these loans, he pledged his collection of thirty-two Chagall paintings, estimated at $30 million.

At the time, the businessman was thinking big – perhaps too big. He initially continued his investments in real estate and luxury hospitality, purchasing the Trianon Palace in Versailles in 2014 and the Sheraton in Roissy in 2016, among others. But he particularly wanted to add a new string to his bow: retail distribution. Within a few years, he built a small empire in this sector, first acquiring several regional Galeries Lafayette stores, then La Grande Récré in 2018, and finally a series of struggling chains often purchased for a symbolic one euro: Camaïeu in August 2020, GAP and Go Sport in 2021.

In a rare interview, Michel Ohayon revealed his strategy in a conversation with Forbes magazine on September 19, 2019. He predicted the revenge of physical stores over e-commerce giants like Amazon. "People are once again favoring local shops. Home delivery has shown its limits... this hyper-digitalization feeds a strong desire to return to physical neighborhood stores," he analyzed. This strategy seemed to bear fruit, at least temporarily. In 2022, he was ranked the 104th richest person in France by Challenges magazine.

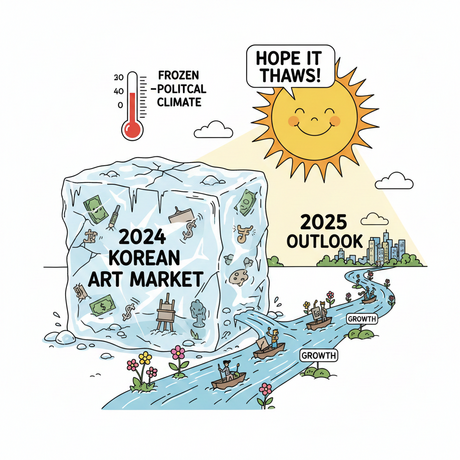

However, his empire was already beginning to crumble. In September of the same year, Camaïeu was placed in judicial liquidation, resulting in 2,600 job losses and the closure of more than 500 stores – one of the country's largest layoff plans. Go Sport and Gap France were subsequently sold at auction. The same scenario repeated each time: an empire built on debt, broken promises, empty accounts, and insufficient cash flow to save these struggling brands.

By 2023, his holding company, Financière immobilière bordelaise (FIB), had ceased payments with €500 million in liabilities. Last April, Michel Ohayon was formally charged with bankruptcy, misuse of corporate assets, and organized fraud, suspected of embezzling money from Go Sport, Gap France, and Camaïeu companies.

As for the Chagall paintings in this entire affair, Barclays eventually lost patience like other creditors of the businessman. In September 2021, the bank seized the art collection. Thirty-two masterpieces now lie dormant in a vault, with no one knowing which specific works they are or obviously where they are located. These treasures are condemned to sleep for a long time behind their armored door.

French authorities suspect a money laundering operation in the acquisition of these paintings through a trust in Luxembourg. A new judicial procedure is underway with Swiss collaboration to determine the purchase conditions of the works and the source of funds that enabled this transaction. The investigation aims to uncover the true origins of both the paintings and the money used to acquire them, adding another layer of complexity to this already intricate case.