A proposed new tax on art ownership has triggered widespread outrage throughout France's art community, with major organizations including the Professional Committee of Art Galleries (Comité Professionel des Galeries d'Art - CPGA) and Art Basel releasing a joint statement on November 14th strongly condemning the legislative proposal. The coalition argues that if enacted, France would become the only major international art hub to impose a wealth tax specifically on the ownership of artworks.

The controversial proposal would transform France's existing Real Estate Wealth Tax (IFI, impôt sur la fortune immobilière) into a broader tax on unproductive wealth that would include works of art within its scope. This legislative change was introduced by Jean-Paul Matteï of the Democratic Movement party and Philippe Brun of the Socialist party, and received provisional approval from Members of Parliament during a first reading on October 31st. The bill is scheduled to appear before the French Senate on November 24th, followed by examination by a joint parliamentary committee before returning to the National Assembly for final consideration.

The joint statement, which has garnered support from 127 signatories, warns of serious economic consequences for France's art market. The statement declares: "While France is gradually catching up with London in the post-Brexit system, a tax on the ownership of artworks would lead collectors to organize their transactions, storage, and conservation facilities in Switzerland, the United States or the United Kingdom." Additional signatories include the visual artist rights organization ADAGP and the Association for the International Diffusion of French Art (ADIAF). Both Matteï and Brun were contacted for comment but have not yet responded.

Industry leaders are expressing grave concerns about the potential impact on France's art market. Mathias Ary Jan, president of the Syndicat des négociants en art, an association representing galleries and dealers, told La Gazette Drouot that the consequences would be "disastrous: a definite flight of works of art and heritage from [France]." The CPGA has announced on its website that it is "immediately mobilizing to defend the tax exemption for works of art and the stability of the French market."

Art Basel, which recently concluded the fourth edition of its Paris fair, issued a statement explaining its decision to sign the joint declaration "to echo the concerns of its galleries and the wider French art ecosystem about the potential inclusion of works as taxable goods in... amendments made to the 2026 French Budget Law, which is currently being debated in parliament." The organization added: "As an active participant in France's cultural landscape, we remain committed to supporting our galleries and ensuring they can continue to thrive."

The opposition extends beyond major institutions to individual artists and creators. More than 1,500 people, many of them working artists, have signed a separate petition opposing the proposed legislation. The petition states: "We, artists, are speaking out today to defend our professions and refuse to allow the fruit of our creation to be reduced to a speculative value." This grassroots movement demonstrates the widespread concern across all levels of the French art community.

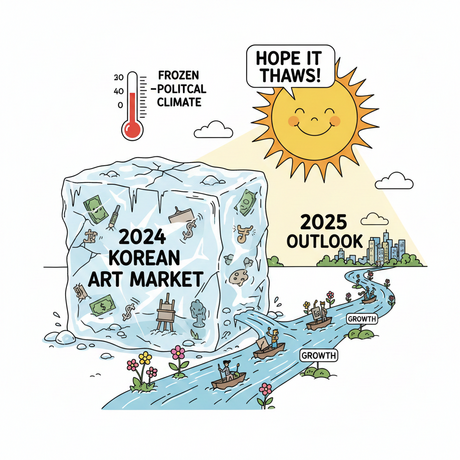

Despite the controversy, France's art market remains a significant force in the global economy. According to the latest Art Basel/UBS report, France contributed more than half of the European Union's art market value in 2024, generating $4.2 billion despite experiencing a 10% year-over-year decline in sales. The country has also secured its position as the fourth-largest art market worldwide, capturing a 7% share of global sales, making the potential impact of this proposed tax even more significant for the international art trade.